All Categories

Featured

Table of Contents

The are whole life insurance policy and global life insurance policy. The cash money value is not included to the death benefit.

The policy lending rate of interest price is 6%. Going this path, the passion he pays goes back right into his policy's cash worth instead of a monetary organization.

Infinite Banking Concept Canada

The principle of Infinite Financial was produced by Nelson Nash in the 1980s. Nash was a finance specialist and fan of the Austrian school of economics, which advocates that the worth of goods aren't explicitly the outcome of conventional financial frameworks like supply and need. Instead, people value cash and products in different ways based on their financial status and requirements.

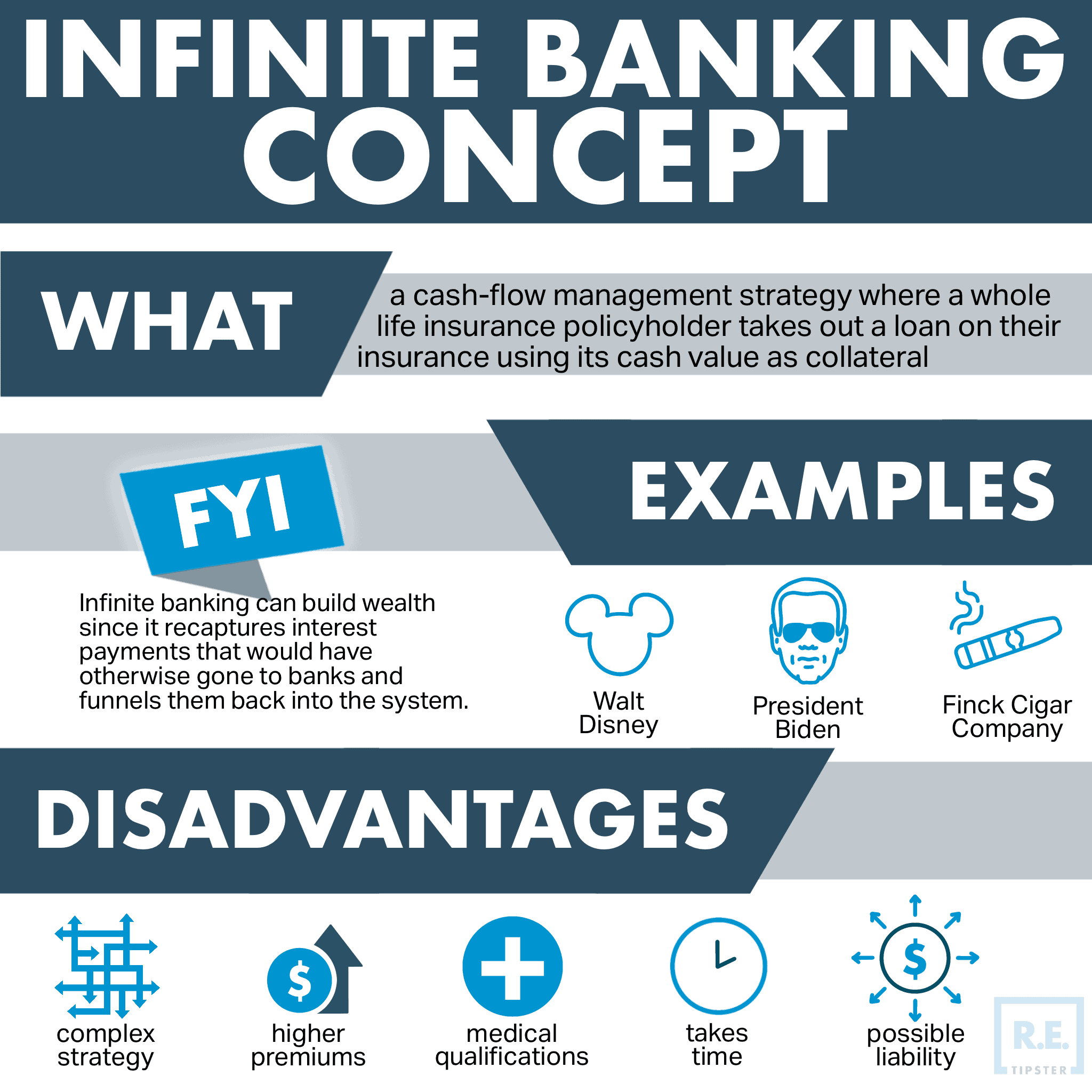

One of the mistakes of typical financial, according to Nash, was high-interest rates on fundings. Long as banks established the interest rates and lending terms, people didn't have control over their own wealth.

Infinite Banking needs you to have your economic future. For ambitious people, it can be the ideal financial tool ever before. Right here are the benefits of Infinite Banking: Arguably the solitary most useful aspect of Infinite Banking is that it boosts your cash flow. You don't need to experience the hoops of a standard bank to obtain a loan; simply request a policy finance from your life insurance coverage firm and funds will certainly be made offered to you.

Dividend-paying entire life insurance policy is really low risk and supplies you, the insurance policy holder, a terrific offer of control. The control that Infinite Banking uses can best be organized into 2 groups: tax obligation benefits and property defenses.

Rbc Visa Infinite Avion Online Banking

When you make use of whole life insurance policy for Infinite Financial, you become part of a personal contract in between you and your insurer. This privacy uses particular property protections not found in other financial vehicles. These protections may differ from state to state, they can consist of security from property searches and seizures, security from reasonings and defense from lenders.

Entire life insurance coverage policies are non-correlated properties. This is why they work so well as the monetary structure of Infinite Banking. Regardless of what happens in the market (stock, actual estate, or otherwise), your insurance coverage plan maintains its worth.

Entire life insurance coverage is that third container. Not just is the price of return on your whole life insurance plan guaranteed, your fatality advantage and costs are also assured.

This structure lines up flawlessly with the concepts of the Perpetual Riches Technique. Infinite Banking charms to those looking for higher economic control. Right here are its major benefits: Liquidity and access: Plan finances supply immediate accessibility to funds without the limitations of typical small business loan. Tax obligation performance: The money worth grows tax-deferred, and policy car loans are tax-free, making it a tax-efficient device for building wealth.

Bioshock Infinite 3rd Cipher Bank

Possession security: In lots of states, the cash money worth of life insurance policy is protected from creditors, including an extra layer of economic protection. While Infinite Banking has its advantages, it isn't a one-size-fits-all option, and it comes with considerable downsides. Right here's why it might not be the most effective approach: Infinite Financial typically needs detailed policy structuring, which can perplex insurance policy holders.

Envision never having to fret regarding financial institution fundings or high passion prices once again. That's the power of unlimited banking life insurance.

There's no collection car loan term, and you have the freedom to choose the payment schedule, which can be as leisurely as settling the car loan at the time of fatality. This versatility prolongs to the maintenance of the car loans, where you can go with interest-only payments, keeping the loan equilibrium flat and manageable.

Holding cash in an IUL dealt with account being credited interest can commonly be better than holding the cash money on deposit at a bank.: You have actually constantly fantasized of opening your own bakery. You can borrow from your IUL policy to cover the initial costs of leasing an area, purchasing equipment, and hiring team.

How To Be Your Own Banker

Individual lendings can be acquired from standard financial institutions and credit history unions. Right here are some vital points to consider. Bank card can give a versatile means to borrow cash for extremely temporary periods. However, borrowing money on a bank card is usually very pricey with interest rate of interest (APR) typically reaching 20% to 30% or more a year.

The tax obligation therapy of plan car loans can differ dramatically depending upon your country of residence and the specific terms of your IUL policy. In some regions, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, policy loans are generally tax-free, supplying a considerable advantage. Nevertheless, in other territories, there may be tax obligation implications to take into consideration, such as potential taxes on the car loan.

Term life insurance only offers a fatality benefit, without any type of cash worth accumulation. This suggests there's no cash value to borrow against. This article is authored by Carlton Crabbe, Ceo of Resources forever, a professional in giving indexed universal life insurance policy accounts. The info provided in this write-up is for educational and informative objectives just and ought to not be interpreted as monetary or investment recommendations.

However, for financing officers, the extensive regulations enforced by the CFPB can be viewed as difficult and restrictive. First, car loan officers frequently suggest that the CFPB's guidelines develop unnecessary red tape, resulting in more documentation and slower lending handling. Guidelines like the TILA-RESPA Integrated Disclosure (TRID) policy and the Ability-to-Repay (ATR) requirements, while targeted at securing customers, can lead to hold-ups in closing deals and increased operational expenses.

Latest Posts

Non Direct Recognition Life Insurance Companies

My Own Bank

The “Be Your Own Bank' Strategy Involves Receiving A Loan From ...